Analysis of TPA experts of the M&A market in the CEE region for the 1st half of 2019:

Fewer transactions but more financial volume 23. 7. 2019

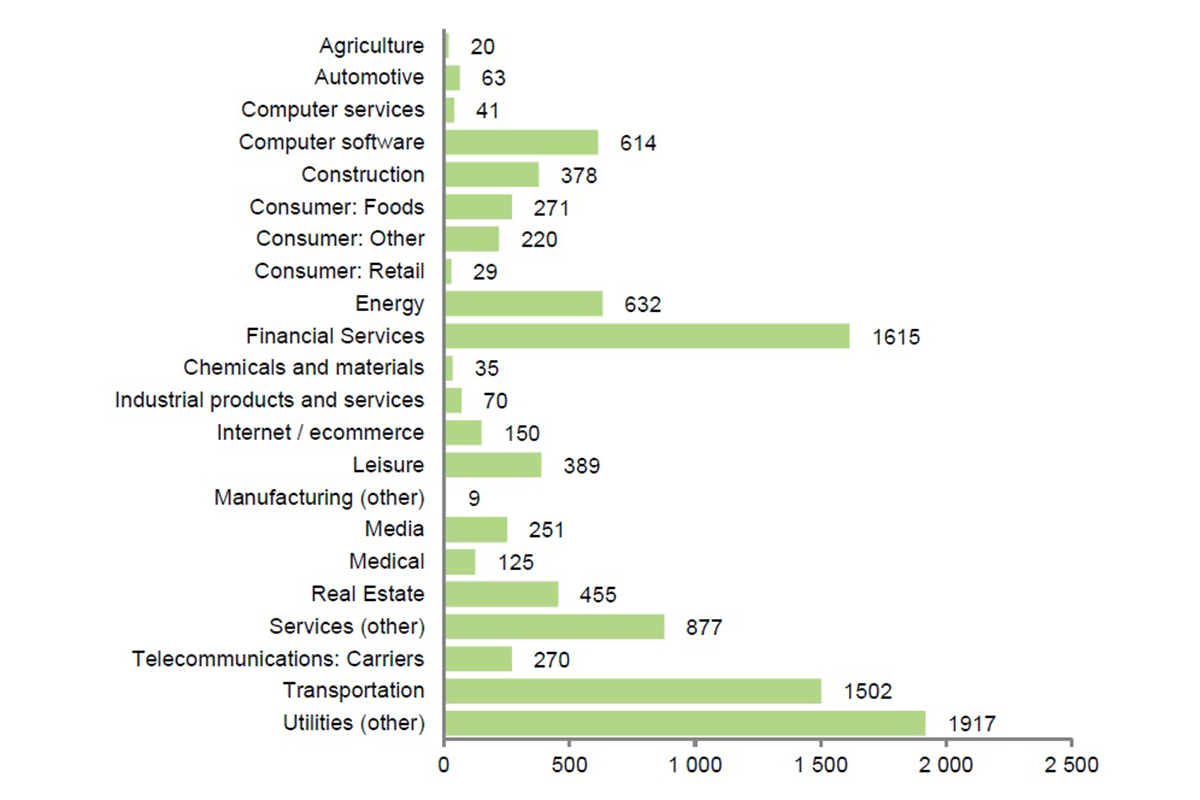

The M&A market recorded 183 transactions in the CEE region in the first half of this year. This is a decrease compared to the previous half-year, when 228 transactions were executed. The volume of transactions with a known purchase price (64) amounted to EUR 9,933 million in 1H 2019 according to the TPA Valuation & Advisory analysis. In 2H 2018 it was EUR 8 457 million for 76 cases reported. Thus, the trend from the first quarter, which also saw a decline in activity compared to 4Q 2018, continues. The largest trading volume, 1.917 mil. EUR, was recorded in 1H 2019 by the utility and finance sectors, 1.615 mil. EUR – see Chart.

In the long run, there is an increasing volume of traded transactions on average. Since 2012, transaction volumes on the CEE market have been rising except for 2017, when there was a slight decline in activity. However, the median EBITDA multiple of more than 10 in 2008 has not yet been surpassed, .

The most active M&A markets: Poland, Austria and Czech Republic

“We focus our M&A market analysis on the region in which our group operates, in Central and Eastern Europe. From 2008 to the end of 1Q 2019, there were almost 5.000 transactions. The most active markets include Poland with a share of approximately 29% in all transactions, followed by Austria with a 20% share and the Czech Republic with a share of approximately 18%. Albania and Montenegro have the least activity, which together account for about 2% of the monitored trades, ”says Jiří Hlaváč, TPA Group partner in the CEE region and expert for merger & acqisitions.

According to tax expert Hlaváč, the increase is obvious, especially in terms of the volume of transactions executed. Market multiples of EBITDA are relatively stable and, given the current market prudence of both private entities and banks, no significant change in return on investors can be expected. Recently, investments in e-commerce and energy have been trending.

TPA’s analysis was based on data available from the Mergermarket database.

The most interesting transactions in the region in 1H 2019

innogy Grid Holding – Czech Republic, price 1,800 million euros

The largest transaction in the first half of 2019 was the sale of a 50.04% stake in the Czech company innogy Grid Holding, a.s. to the Australian investor association Macquarie Infrastructure and Real Assets operating under the investment bank Macquarie Group. The association became 100% owner of this transaction. Innogy Grid Holding, through its subsidiary GasNet, sro, distributes natural gas in the Czech Republic, with the exception of the South Bohemian Region and the capital in which competing companies operate. The company supplies 2.3 million connections within a network of approximately 65,000 kilometers. The value of the transaction reached EUR 1.8 billion.

Kiwi.com – Czech Republic, price 116 million euros

The American investment company General Atlantic Service Comapy, L.P., has bought a 51% stake in the Czech company Kiwi.com, s.r.o. Kiwi.com operates a traffic finder for companies that usually do not cooperate with each other, with almost all types of public transport included. In addition to searching, the platform provides accommodation or car rental in cooperation with other websites. This makes traveling easier and cheaper for travelers. The company was founded under the name Skypicker in 2012 as a search engine for cheap air tickets and from the beginning it was a very successful start-up, which has been profitable since the first years. In addition, only $ 1.4 million has been invested since its inception.

Warhouse Studios – Czech Republic, price 33 million euros

The Austrian-German company Koch Media GmbH bought Czech game studio Warhorse Studios s.r.o. Zdeněk Bakala, a businessman, investor and philanthropist, held a 70% stake in the company. In February 2018 the studio released the RPG game Kingdom Come: Deliverance, which takes place in medieval Bohemia. The development of the game had a lot of support on the crowdfunding platform Kickstarter, where in 2015 individual investors supported it with the amount of 1.4 million euros. By the end of 2018, more than two million copies had been sold, and the company was likely to have generated revenues of EUR 50-100 million. The Warhorse project is backed by a team whose members have previously participated in big name games such as Mafia and Flashpoint, which are internationally recognized and have sold millions of pieces across platforms. In addition to game development, Koch Media is also involved in film production and software development.

Source: MergerMarket.com

- M&A Deals in Serbia from 2014-2019

- Latest News from CEE/SEE

- Are you looking for a professional advisor in the Czech Republic?