On 6 July 2016 the EU Tax Amendment Act 2016 (EU-Abgabenänderungsgesetz 2016) was passed. The law introduces mandatory standards for Transfer Pricing Documentation in Austria.

Below you will find brief answers to the most frequently asked questions:

1. What companies in Austria are affected?

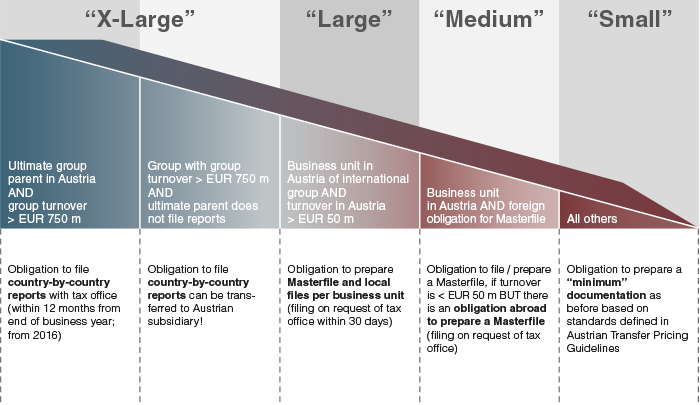

Ultimate group parent companies with an annual consolidated group revenue of at least EUR 750 million.

- Country-by-country Reporting (“Documentation X-Large”): Country-by-country-Reporting is a standard provided by OECD Base Erosion and Profit Shifting Plan (BEPS Plan) that basically relates to ultimate parent companies of MNE groups with an annual consolidated group revenue of at least EUR 750 million.

In a paper published on 29 June 2016 the OECD provided a couple of clarifications, inter alia, that the Country-by-Country Reporting criteria are based on the consolidation requirements according to accounting standards. This has for example the following implications:

- There is no mandatory Country-by-Country-Reporting for investment funds, as long as there is no consolidation requirement according to the applicable accounting regulations.

- The same is true for partnerships as ultimate group parent companies.

Under certain circumstances a tax authority may adopt a decision imposing an obligation to submit transfer pricing documentation on another group company, resident of Austria, if an ultimate parent company does not submit the documentation or is not obliged to do so. This is normally the case, where an ultimate parent company is a resident of a third country that has not adopted the mandatory Country-by-country Reporting rules.

(Austrian) business unit with revenue of at least EUR 50 million.

- “Documentation Large”: Austrian business units with a revenue of at least EUR 50 million in two immediately preceding fiscal years and belonging to a MNE group, that operates in at least two countries, will also become now subject to transfer pricing documentation requirements.(Austrian) Group companies are further required to have a Master File in cases where the turnover threshold is not met in Austria, but a foreign group company is obliged to prepare a Master File according to the rules applicable in the jurisdiction of this foreign company. (“Documentation Medium”)

- Austrian companies, that do not fall under one or both categories above, remain subject to the general and previously existing Austrian documentation requirements. (“Documentation Small”)

- TPA expert’s tip: Contact local Transfer Pricing expert at TPA Austria if you have questions about international taxation and transfer pricing documentation

2. When does the new transfer pricing documentation requirement start?

The new requirement should generally apply to all fiscal years beginning on or after 1 January 2016 in Austria.

3. What is the content of the new documentation?

- Country-by-country Reporting (“Documentation X-Large”): Country-by-country-Reporting consists of 3 predefined forms containing information relating to certain financial indicators and the global allocation of the MNE’s income and taxes, as well as functions and risks per country, where an MNE group operates.

- “Documentation Large”: The documentation requirement entails a preparation of a Master File and a Local File for a respective business unit.The Master File should provide a general overview of the MNE group business and its overall transfer pricing practices. In comparison to the existing EU Master File standard, the scope of the Master File is extended (in particular analysis of value drivers in business model and value added chains, details regarding the use of intellectual property etc.)

The Local File supplements the Master File providing for more detailed information (including financial details) with regards to each local business unit.

4. What are the Compliance requirements in terms of timing?

- Country-by-country Reports: The Country-by-country Reports should be filed with a competent tax authority within 12 months after the end of the respective fiscal year by an ultimate parent entity or another group entity, entitled to represent the ultimate parent entity.The competent tax authority shares this information subsequently with all jurisdictions, where business units of an MNE group operate, provided that these jurisdictions have joined the Convention on Mutual Administrative Assistance in Tax Matters.

- Documentation “X-Large, Large and Medium”: The Master File and Local Files should be finalized by the time the tax return is filed and provided within 30 days upon request of a tax authority.

- Documentation “Small”: Although no special time frames are provided here, we strongly recommend preparing all documentation relevant for the respective intercompany transactions on time.

5. Are there any penalties for non-compliance?

Penalties up to EUR 50,000 are stipulated in regard to Country-by-country Reports, in the event that they are not filed or filed not completely or not correctly.

6. What has to be done next?

- Documentation “X-Large”:

Austrian ultimate parent companies need to communicate their duty to file the Country-by-country Reports in Austria to the competent tax authorities in Austria as well as to all other group companies. As a result, the determination of the financial indicators for the year 2016 should be organizationally prepared.Austrian group companies should agree whether the documentation requirement exists abroad and/or whether there is a risk that they might become subject to it in Austria. The results should be communicated to the Austrian tax authorities until end of the business year for which the reports need to be filed. - Documentation “Large” and “Medium”: It is in any case advisable to review whether the existing documentation contains all the required information and whether it needs to be expanded. In cases where only the Master File has been prepared, Local Files have to be added for each group entity.

- Documentation “Small”: In cases where there is no need for new documentation, the existing documentation should also be reviewed, as one can expect an increased standard of documentation will now be required.

TPA Transfer Pricing Group Desk

We are happy to answer any further questions you may have and to support you in preparing the transfer pricing documentation! If you have questions about the OECD BEPS Action plan in Austria and Europe contact our transfer pricing experts for consilidation.

The chart below gives a brief overview on the new documentation standards:

Find out more about Transfer Pricing Documentation in Europe:

- Serbia: Transfer Pricing Documentation

- Slovakia: Country by Country reports

- Poland: Country by Country Reporting